do you pay california state taxes if you live in nevada

The state of California requires residents to pay personal income taxes but Nevada does not. If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada.

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company

The second rule is that California will tax income generated in the.

. Click to see full answer Then do I have to pay California income tax if I live out of state. My second home is in Nevada. If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of company do I have to pay California state taxes for 365 days or for just 65 days.

The state of California requires residents to pay personal income taxes but Nevada does not. Did you know that laws vary by state. Californias Franchise Tax Board administers the states income tax program.

If you live in Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas or Washington you wont be taxed. Taxes on the sale of a 1000000 in CA is 12500. If you lived inside or outside of California during the tax year you may be a part-year resident.

The minimum wage in Nevada is 725. June 6 2019 831 AM Yes you need to file a non-resident state return for the California income. Answer 1 of 6.

Even where California agrees that you moved they might not agree when you moved. Therefore depending on your total income you may have made enough money in California for them to have taxed you through the year. If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada.

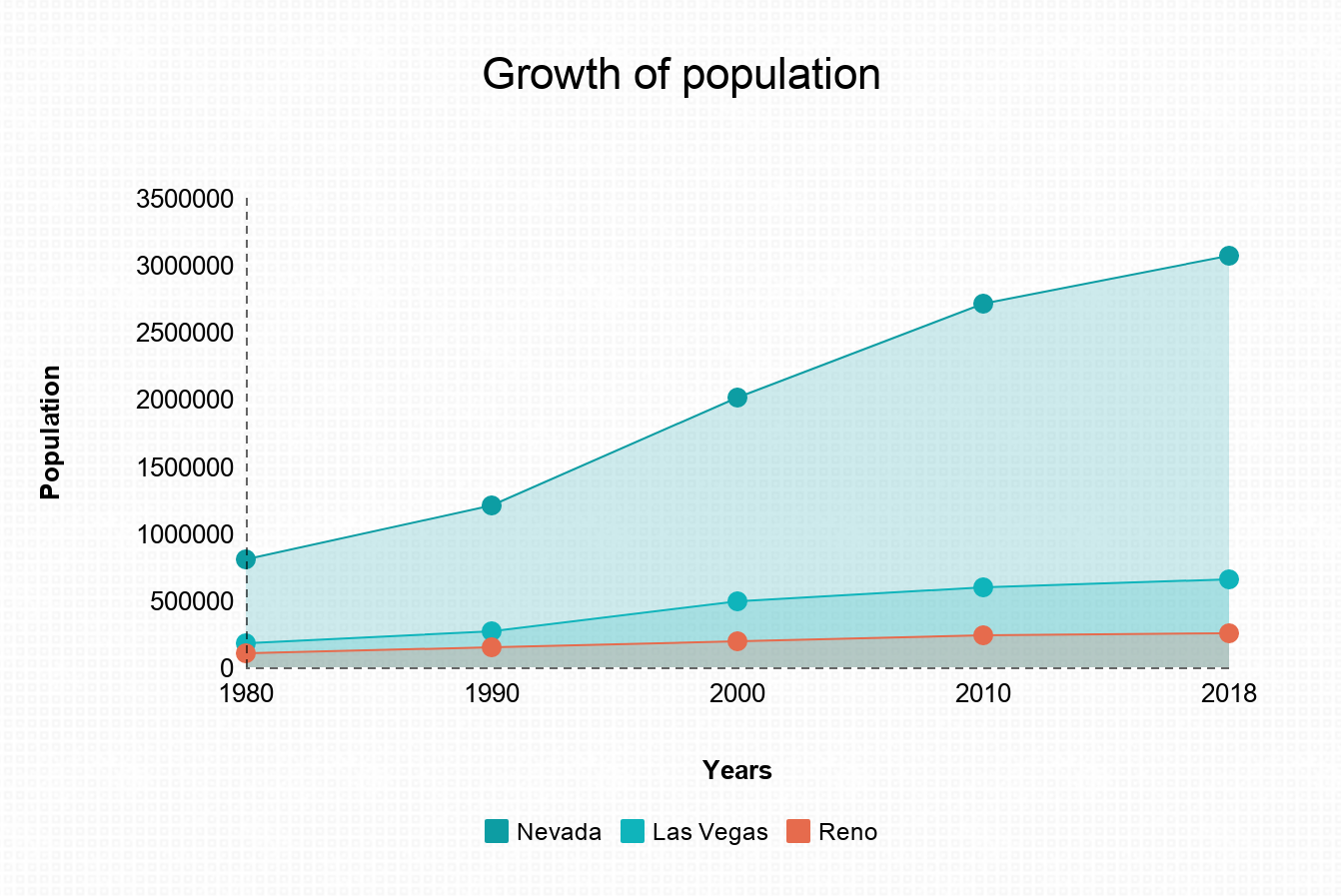

Assume there is no Nevada location of the Company. If you move from California to Nevada this seems to avoid California state taxes in many instances. After all Californias 133 tax on capital gains inspires plenty of tax moves.

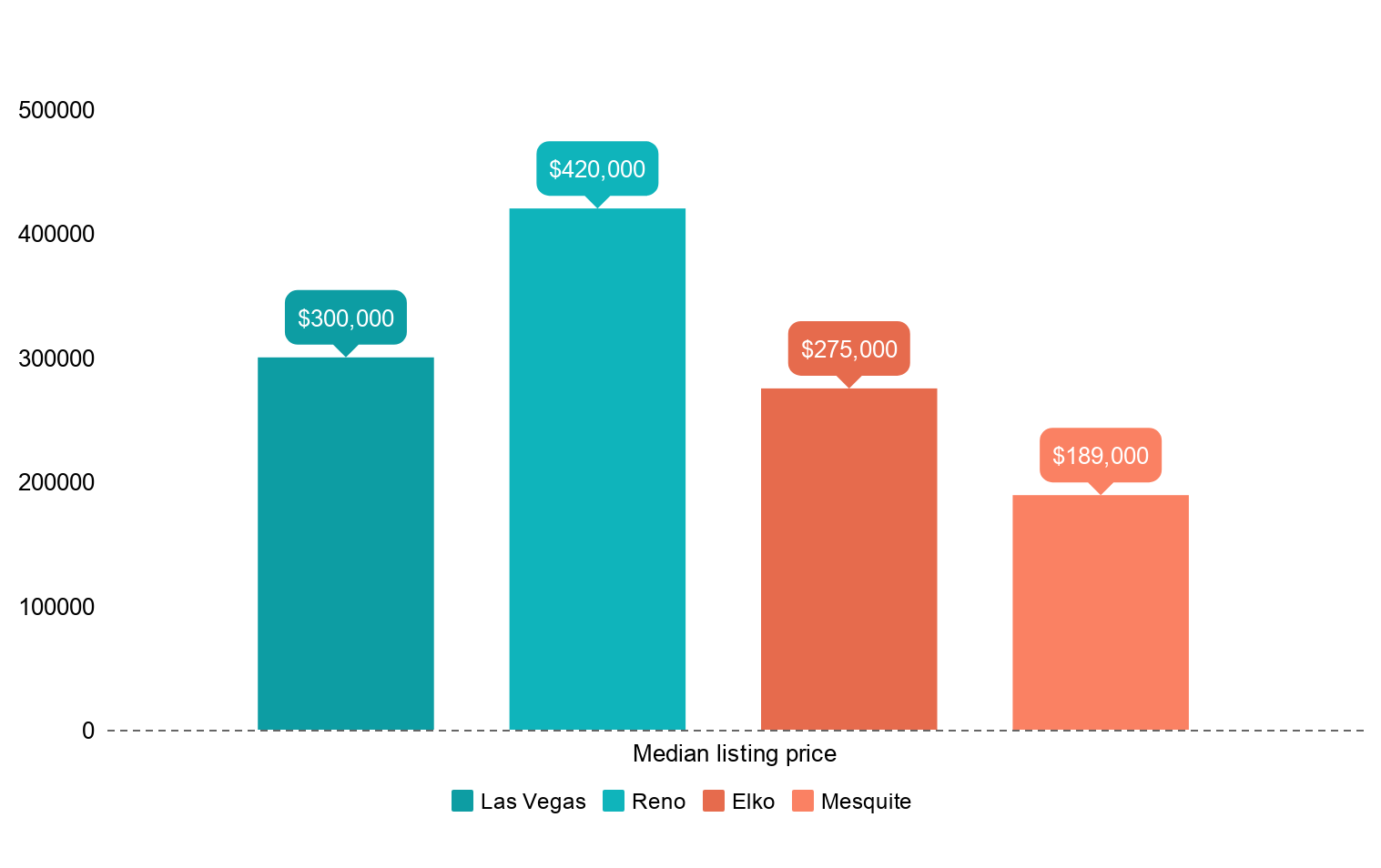

Nevada property taxes one of the lowest in the nation average 077 of the assessed land value. My primary residence is in Tennessee. Living in any of the other 41 states will mean filing and paying state income taxes.

Say you move from California to. The confusing part is whether or not you will have to pay taxes in the state where your employer is located. Californians can forget about a state income tax they had to pay as well as pay less for food and medicine because there is no sale tax on these goods too.

Assume you have a sale for 1000000 in Nevada and California. You will have to prove that you are not a California resident and prove that you didnt put one toe into California for. If you work for a California company chances are you will pay California taxes despite the fact that you live in a no-tax state like Nevada.

The minimum wage in California ranges from 1050 to 1100 per hour. Say however you Ask an Expert Tax Questions Barbara 24273 satisfied customers. PROPERTY TAXES Property taxes in California are in the range of 11 to 16 of the assessed land value.

You will have to pay California tax on your distributive share of the companys LLC income despite the LLC having earned all of its income outside of California say another state like Nevada. Nevada taxes will stay the same through the end of the fiscal year. The yearly cap on taxes is 3.

The state sales tax in Nevada is 46 which is 265 lower than its neighbor to the west. Californias Franchise Tax Board administers the states income tax program. How long do you have to live in Nevada to be a.

You will want to file the non-resident first and then your Nevada state return so that your state return can be calculated correctly against any credit from the non-resident CA state return. Despite a widely known fact that in Nevada you can work only in a casino hotel or restaurant in fact the modern job market is more extended. Like in California different cities and municipalities often add in local sales taxes.

While federal law prevents California and other states from taxing pension income of non-residents you may have to pay taxes on this income to. ALEX O Partner O G Tax Masters Degree 6334 satisfied customers I have two homes. Some states do require gambling winners to claim the gambling winnings in the state where they were won.

This bring the highest possible total sales tax in Nevada to 8375 which is still over two percent cheaper than Californias highest rates. Most states tax all income earned in their state regardless of your residency. However even though you do not live in California you still must pay tax on income earned in California as a nonresident.

Taxes on a 1000000 is approximately 6000. It is true that in Nevada you do not pay tax on that income but California can tax you. It is true that in Nevada you do not pay tax on that income but California can tax you.

Typically taxes on Incline Village properties run 6 of 1 of the value of the home. Follow this TurboTax FAQ to file the non-resident return.

Nevada Sales Tax Small Business Guide Truic

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Retirement Retirement Locations

South Shore Lake Tahoe South Lake Tahoe Lake Tahoe Lake Tahoe Nevada

Nevada Vs California Taxes Explained Retirebetternow Com

Moving To Nevada From California Retirebetternow Com

Nevada The New California The Nevada Independent

Nevada Vs California For Retirement Which Is Better 2020 Aging Greatly

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

Moving To Nevada From California Retirebetternow Com

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company

Moving Avoids California Tax Not So Fast

Nevada Vs California Taxes Retirepedia

Margy S Musings Pyramid Lake Nevada Nevada Travel Travel California Camping

Nevada Vs California Taxes Retirepedia

Nevada Vs California Taxes Retirepedia

Taxes In Nevada Vs California And How They Affect You Kim Walker Cpa

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company

Get Ready To Pay Sales Tax On Amazon Amazon Sale Sales Tax Amazon Purchases